Depreciation equipment calculator

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Manufacturing Equipment Depreciation Calculation Depreciation Guru

This makes the assumption that your heavy equipment will depreciate at the same rate every year of its useful life until it reaches its salvage value.

. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. Salvage value cost value annual depreciation x useful life If you have construction equipment that you bought for 200000 you can use the depreciated value at. Section 179 deduction dollar limits.

Office Equipment Depreciation Calculator The calculator should be used as a general guide only. High-Tech Medical Equipment Depreciation Calculator The calculator should be used as a general guide only. The template displays the.

There are many variables which can affect an items life expectancy that should be. One way to calculate depreciation is to spread the cost of an asset evenly over its. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

The calculator should be used as a general guide only. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of. There are many variables which can affect an items life expectancy that should be taken into consideration.

This limit is reduced by the amount by which the cost of. The calculator should be used as a general guide only. There are many variables which can affect an items life expectancy that should be taken into.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. This depreciation calculator will determine the actual cash value of your.

High-Tech Medical Equipment Depreciation Calculator The calculator should be used as a general guide only. Common assets that depreciate quickly include equipment cars phones and even rental properties. There are many variables which can affect an items life expectancy that should be taken into consideration.

There are many variables which can affect an items life expectancy that. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. The MACRS Depreciation Calculator uses the following basic formula.

Depreciation Amount Asset Value x Annual Percentage Balance.

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

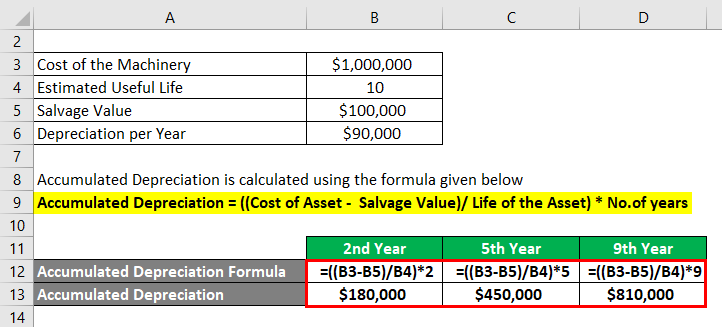

Accumulated Depreciation Formula Calculator With Excel Template

Computer Related Equipment Depreciation Calculation Depreciation Guru

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Straight Line Depreciation Calculator Double Entry Bookkeeping

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Manufacturing Equipment Depreciation Calculation Depreciation Guru

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Declining Balance Depreciation Calculator

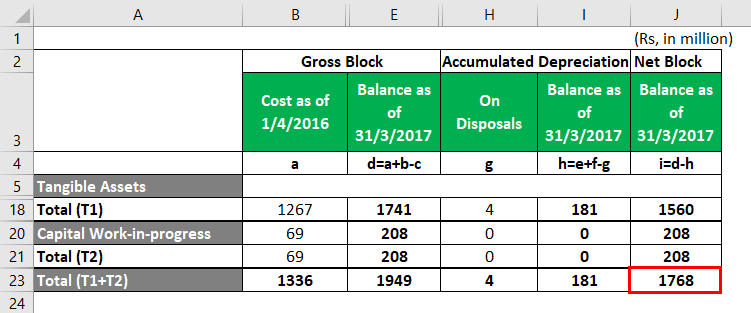

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation What Is The Depreciation Expense