Stock intrinsic value calculator excel

So if the market environment is inflationary ending inventory value will be higher since items which are purchased at a higher. Rate of Return Apple 1200 1000 100 1000.

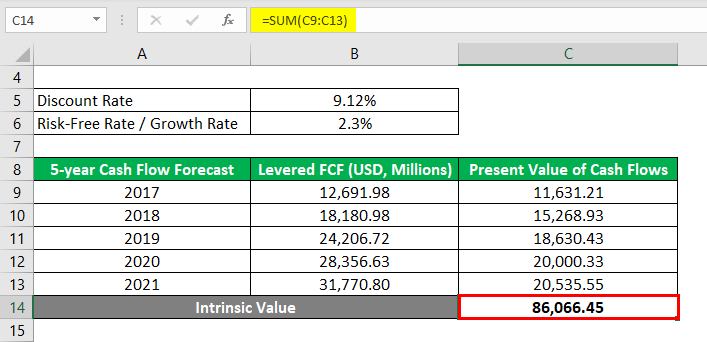

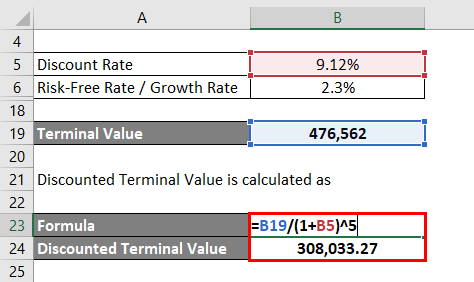

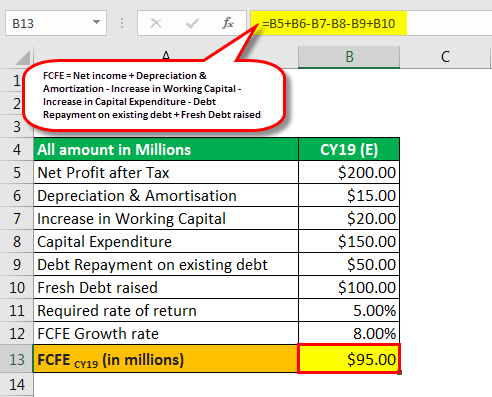

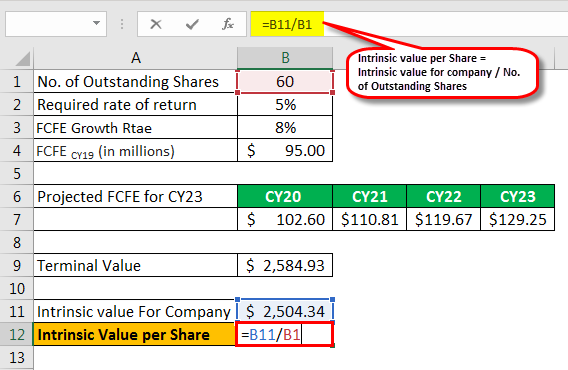

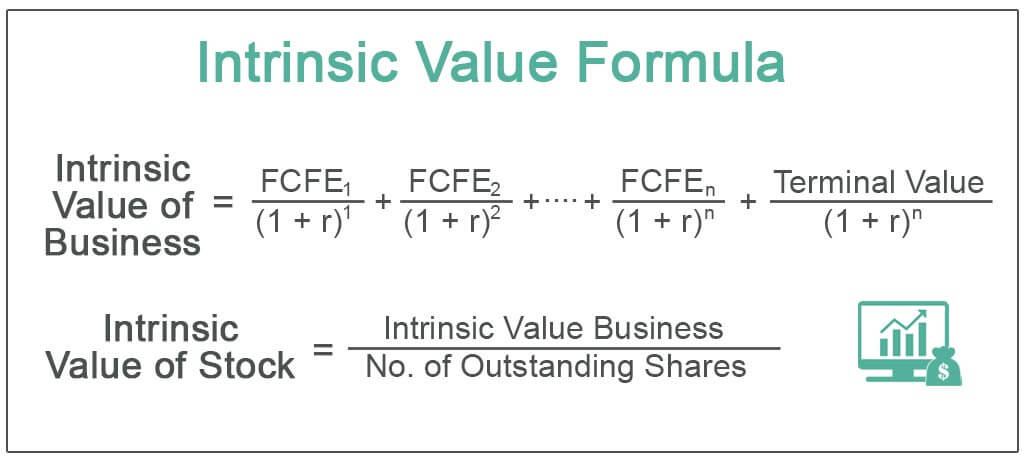

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Next determine the number of outstanding treasury stocks and the cost of acquisition of each stock.

. We discuss how to use a DCF model in more detail here and you can download our free stock valuation excel template here. Whether Company Z should take Rs. Intrinsic Value Calcluation Formula and Example.

Now in order to understand which of either deal is better ie. It uses constant base-year prices for measuring the value of final goods and services. It is very easy and simple.

Terminal Value TV Definition. There are 3 different ways of calculating ending inventory. Next determine the value of additional paid-in capital which the surplus value paid the stock investors over and above the nominal price of the common stock.

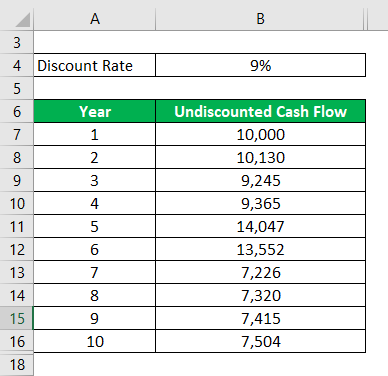

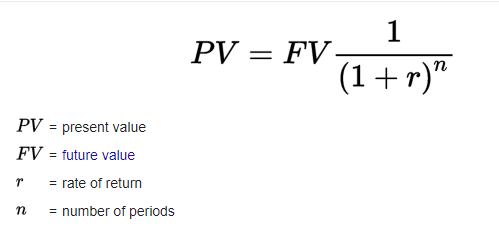

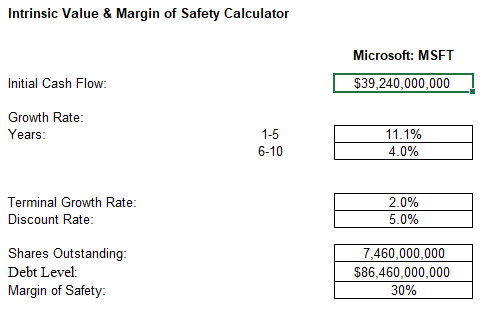

Intrinsic Value DCF Guide Intrinsic Value DCF Guide Intrinsic Value Concepts Intrinsic Value Time Value of Money TVM Present Value PV Future Value. Price to Earning Ratio Formula in Excel With Excel Template Here we will do the same example of the PE Ratio formula in Excel. But today we are focusing on a different method for calculating a stocks intrinsic value.

Net working capital 106072 98279. Since it is not feasible to project a companys FCF. The above formula is used when direct inputs like units and sell value per unit is available however when product or service cannot be calculated in that direct way then another way to calculate sales revenue is to add up the cost and find the revenue through the method called absorption.

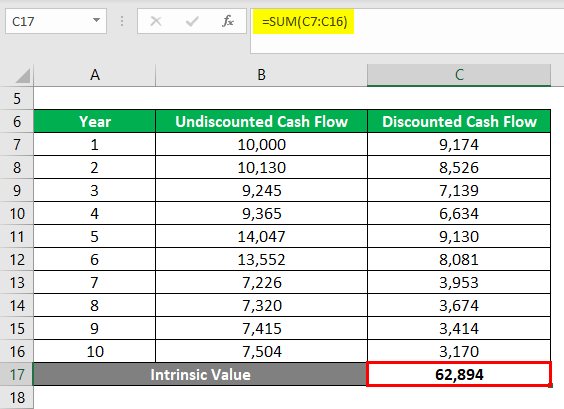

A stock portfolio tracker using Google Drive with advanced functions than your average tracker. Intrinsic Value Calculation Formula As 100 today is worth more than 100 next year when it comes to calculating the intrinsic value of a stock we need to calculate the present value of each future cash flow. Inventory is one of the major important factors for tracking the manufacturing company.

5000 then it is better for Company Z to take money after two years otherwise take Rs. Discount Factor Formula Approach 1 The present value of a cash flow ie. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product.

The market cap represents the value of the entire company to only one group of capital providers which is the common shareholders. Firstly we will uncover how Warren Buffett calculates Intrinsic Value using the Discounted Cash Flow Model DCF. I dont do complicated transactions but still nothing could really satisfy meBut.

Then the rate of return will be. This intrinsic value is the real value of the company based on its cash flows assets and financial situation. You can easily calculate the Opportunity Cost using Formula in the template provided.

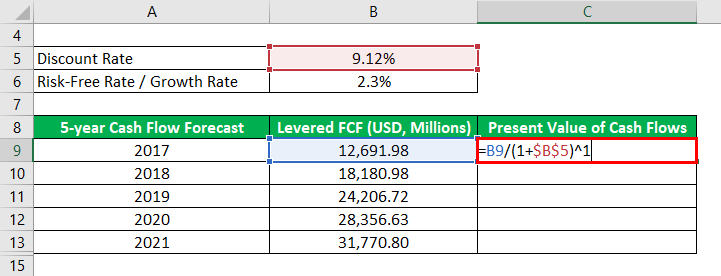

5000 if the present value of Rs. Apple Inc Balance sheet Explanation. The premise of the DCF approach states that an asset the company is worth the sum of all of its future free cash flows FCFs which are discounted to the present day to account for the time value of money ie 1 received today is worth more than 1 received on a later date.

In the same time horizon between 2010 and 2020 the 10-year Treasury note remained in the 2 to 3 range. The last formula can be used in the service industry to calculate the sales revenue of the firm. Market Price of Share and Earnings per Share.

The calculated future value FV is a function of the interest rate assumption ie. Our starting point the equity value ie. Rate of Return Apple 20.

Cost of Preferred Stock Calculator Excel Template. It is very easy and simple. Now if instead of Apple Intel stock increase by 15 due to positive results the stock price will move to 5372 and the index will move to 10503 an increase of 228 So if you see a 15 increase in higher price stock will move the index by 76 whereas the same increase in lower price stock has less impact on the index price.

Inventory Turnover Ratio Calculator. Download Corporate Valuation Investment Banking Accounting CFA Calculator others It is also known as an inflation-adjusted gross domestic product. Movement in inventory gives a clear picture of a companys ability to turn raw material into a finished product.

You can easily calculate the Capacity Utilization Rate using Formula in the template provided. FIFO First IN First OUT Method. Rate of Return Current Value Original Value 100 Original Value.

In addition you can find whether the. In this method items which are purchased first will be sold first and the remaining items will be the latest purchases. Well now move to a modeling exercise which you can access by filling out the form below.

Net working capital 7793 Cr Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. You need to provide the two inputs actual output and Maximum possible output. DCF Calculator is used for calculating the intrinsic value IV in other words the true value of the company.

5500 after two years we need to calculate a present value of Rs. Investors should ideally buy the stocks at near the intrinsic value of the company. The mechanical part of how to calculate intrinsic value the intrinsic value formula is the easy part.

The product of both will give the value of the preferred stock. Stock market has averaged a 10-year return of 92 according to research by Goldman Sachs with a 136 annual return in the trailing ten years from 2020 pre-COVID Source. It is very easy and simple.

Examples of Debt Service Coverage Ratio Formula With Excel Template Debt Service Coverage Ratio Formula Calculator. The formula for a stock turnover ratio can be derived by using the following steps. To calculate the enterprise value of a company you first take the companys equity value and then add net debt preferred stock and minority interest.

Suppose an investor invests 1000 in shares of Apple Company in 2015 and sold his stock in 2016 at 1200. Intrinsic value is often calculated using a discounted cash flow DCF model. Rate of Return Apple 200 100 1000.

Debt service coverage ratio as its name suggests is the amount of cash a company has to servicepay its current debt obligations interest on a debt principal payment lease payment etc. You need to provide the two inputs ie. Net Working Capital Total Current Assets Total Current Liabilities.

The Intrinsic Value or Fair Value of stock estimates a stocks value without regard for the stock markets valuation. The rate of return earned on the original amount of capital invested or the present value PV. Opportunity Cost Formula in Excel With Excel Template Here we will do the same example of the Opportunity Cost formula in Excel.

Inventory Turnover Ratio Formula in Excel With Excel Template Inventory Turnover Ratio. Profitability from First Order is calculated using Opportunity Cost Formula. Methods For Calculating Ending Inventory.

Capacity Utilization Rate Formula in Excel With Excel Template Here we will do the same example of the Capacity Utilization Rate formula in Excel. You can easily calculate the PE Ratio using Formula in the template provided. Generally speaking there are two approaches to calculating the discount factor but in either case the.

The value of future cash in todays dollars is calculated by multiplying the cash flow for each projected year by the discount factor which is driven by the discount rate and the matching time period. Debt Service Coverage Ratio Formula. 5000 today or Rs.

5500 on the current interest rate and then compare it with Rs. Get it for yourselfA project that Ive always had was to improve on my stock portfolio tracking spreadsheetsDuring this time Ive probably used 10 or so different portfolio trackers but nothing met my needs. For investors and corporations alike the future value FV is calculated to estimate the value of an investment on a later date to guide decision-making.

5500 is higher than Rs.

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

5 Steps To Calculate Intrinsic Value Youtube

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

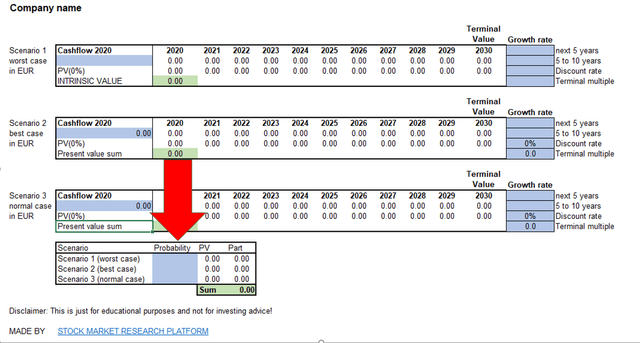

Intrinsic Value Calculator Excel Intrinsic Value Calculator Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate The Intrinsic Value In Excel Like A Pro Beginners Getmoneyrich

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

How To Find The Intrinsic Value Of A Company S Stock In Excel Eps Multiplier Method Youtube

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

How To Find The Intrinsic Value Of A Stock In Excel Graham Intrinsic Value Formula Youtube

Intrinsic Value Formula Example How To Calculate Intrinsic Value Intrinsic Value Intrinsic Company Values

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

How To Calculate The Intrinsic Value Of A Stock Excel Calculator

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template